Last week Denmark launched the biggest offshore wind tender to date – aimed at bringing a whopping 6-10 GW of new capacity online by end of 2030. With neighboring countries, such as the UK, Germany and the Netherlands having similarly high ambitions for 2030, competition for the offshore wind supply chain may be a deciding factor in which projects can actually hit target CODs.

Developers will face penalties if they are delayed, so will infrastructure and supply chain be able to support this capacity?

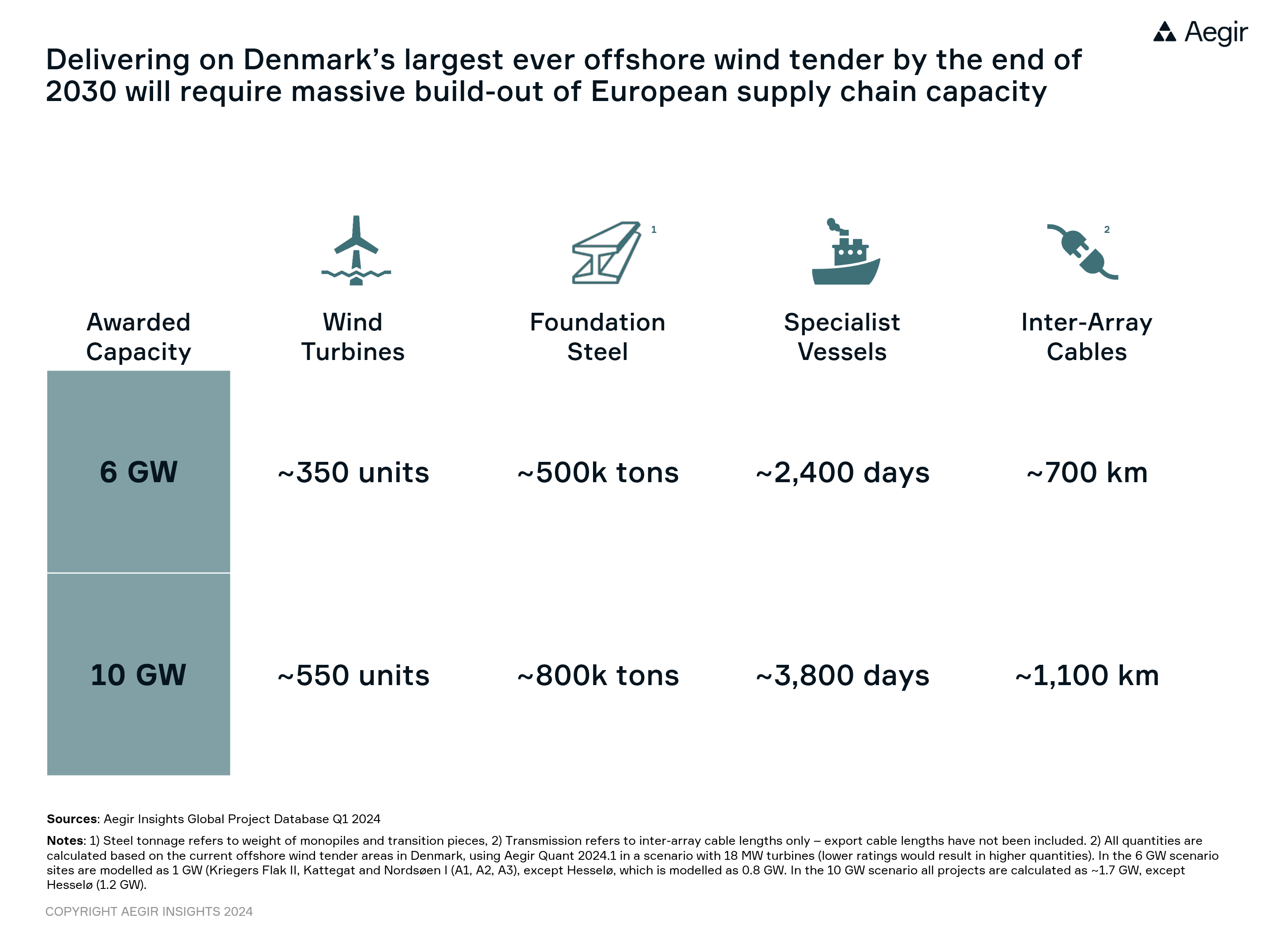

We modelled two capacity scenarios across the six Danish sites (Nordsøen I (A1, A2, A3), Hesselø, Kattegat and Kriegers Flak II) to map out quantities of demand that will be generated if all projects are executed in parallel, ending in 2030 – for the minimum planned capacity of 6 GW or if all the overplanting is realized for a total capacity of 10 GW:

- Across the six sites almost 350 new wind turbines with over 1,000 new blades will need to be installed in the 6 GW scenario (based on generic assumption of 18 MW turbines).

- This requires 350 foundations (monopiles and transition pieces) amounting to 500,000 tons of steel needing to be put into water.

- To bring all the electricity from the wind farms to shore, 700 km of inter-array cabling and up to 1,000 km of export cables will be needed.

- And finally, farm construction will require almost 2,400 days from specialist installation vessels.

This is assuming that developers only seek to build-out the minimum 6 GW of capacity.

The full 10 GW of capacity would require more than 550 turbines and foundations to be deployed in Denmark from 2028 to 2030 – increasing the competition for procurement in the northern European offshore wind supply chain during that period.

And what will happen for developers in terms of penalties in case of delays?

Could the success of Denmark’s offshore wind tender be at risk?

The Danish tender is one of this year's most anticipated offshore wind auctions and will be interesting to follow. However, Aegir Insights' recent analysis shows the economics are looking tight.

- Standalone project returns (% IRR) indicate that it could be very challenging to meet typically expected return requirements. Returns could be as low as 3 to 6% – even on sites in the North Sea with excellent site conditions.

- Considering different value levers of potential bidders, Aegir estimates approximately 2% absolute IRR delta between best and worst case for potential bidders.

Aegir Insights' Data & Analytics products

To dive in for deeper insights on the evolving dynamics in the offshore wind supply chain as more and more countries gear up for holding auctions with aggressive COD targets, reach out to us for information on our Data products for offshore wind projects, supply chain and more, as well as our sophisticated commercial toolchain to support your bid strategy and decision making.