The newest offtake auction results from New Jersey confirm that American states are willing to pay higher prices for offshore wind.

Two leading offshore wind states, New York and New Jersey, have now announced the first big offtake auction results since 2023’s project cancellations and consequent re-set for American offshore wind:

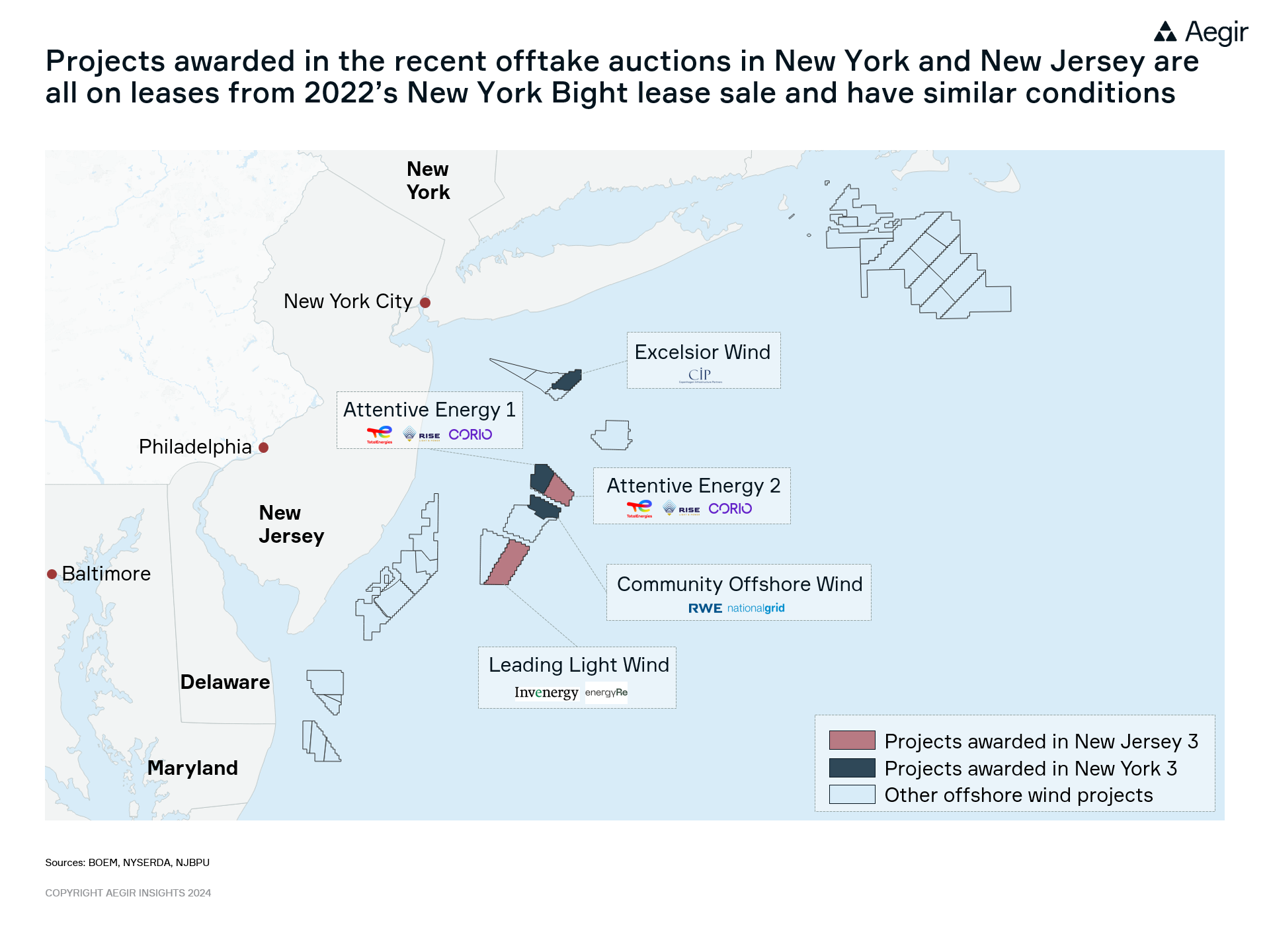

- New Jersey reported in January that it had awarded contracts to two projects: Leading Light Wind (2.4 GW) won with a first-year all-in nominal price of 112 USD/MWh, and Attentive Energy 2 (1.34 GW) won with a first-year all-in nominal price of 131 USD/MWh.

- Back in October, New York announced that Excelsior Wind (1.3 GW), Community Offshore Wind (1.3 GW) and Attentive Energy 1 (1.4 GW) won offtake contracts with a nominal weighted average strike price of 145 USD/MWh over the lifetimes of the three winning projects.

At first glance, it could seem as if New Jersey managed to get lower bids than New York – which would be surprising, considering that all five projects in question are located in almost the exact same area and have very similar wind speeds and water depths. It is also not the case:

In New Jersey, annual escalators of 2.5 or 3 % mean that the prices increase year by year over the twenty years the contracts last – from 112 to 189 USD/MWh and from 131 to 237 USD/MWh, respectively. Furthermore, other factors such as different contract term lengths and transmission scopes, as well as the lack of insight into how exactly the announced results were calculated, must be considered when comparing results of different auctions.

Accounting for as many of these factors as possible, Aegir estimates that the net present value of the contract awarded by New Jersey to Attentive Energy 2 is almost the same as that of the three New York contracts. Only Leading Light Wind stands out with a lower net present value of the contract, relative to project capacity.

Overall, the New Jersey results fortify the trend set by New York in October – that states recognize the economic pressures affecting offshore wind projects and remain committed to the development of the industry, even at temporarily higher prices.

Aegir Insights offshore wind market intelligence on the US

Aegir Insights’ clients can reach out to Signe Sørensen to schedule an analyst session covering the latest developments in US offshore wind and unpacking recent auction results.

If you’re not a client yet but would like more information on Aegir Insights’ offshore wind market intelligence including our upcoming market report on the Atlantic US, reach out to us here for more information.